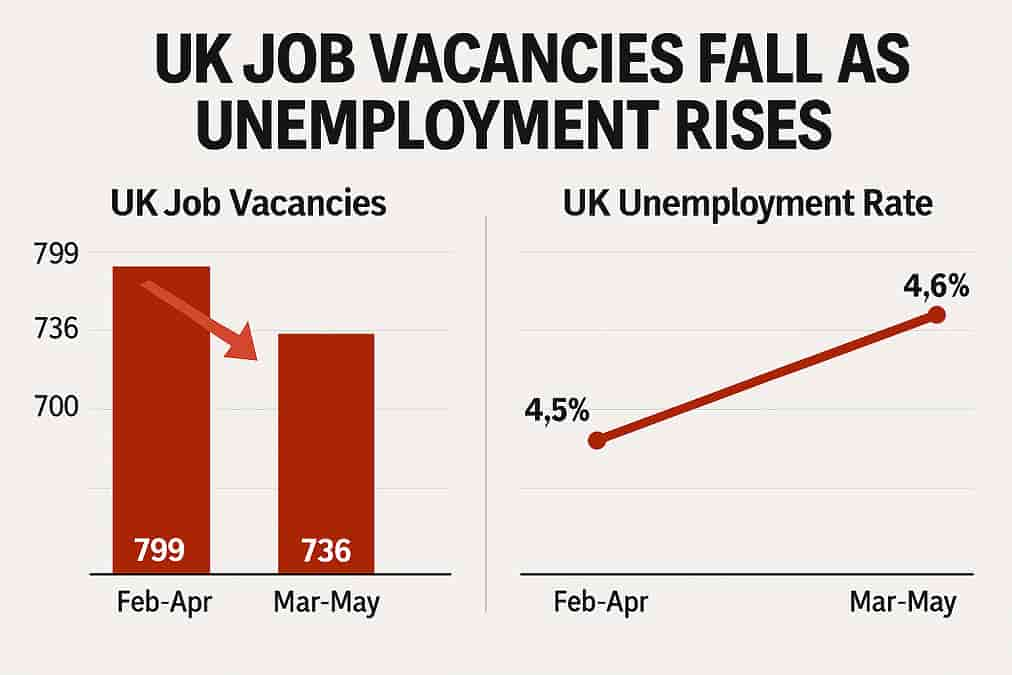

The United Kingdom is witnessing a notable slowdown in recruitment activity as job vacancies across the country continue to decline. According to the latest official figures from the Office for National Statistics (ONS), the number of available roles fell sharply by 63,000 between March and May 2025. The data underlines growing caution among employers who are either reluctant to hire or are opting not to replace outgoing staff.

This contraction in job openings brings the total estimated vacancies to 736,000 — a figure not seen since early stages of the post-pandemic recovery. In tandem, the unemployment rate has inched upwards to 4.6%, marking the highest level recorded since July 2021. The rise from 4.5% last quarter, although modest, reflects a softening in the UK’s labour market amid uncertain economic conditions.

Liz McKeown, Director of Economic Statistics at the ONS, commented on the emerging trend, stating:

“There continues to be a weakening in the labour market. Notably, our payroll data also shows a drop in the number of people in employment. Feedback from our vacancies survey suggests some firms may be holding back from recruiting new workers or replacing people when they move on.”

The downturn in job creation coincides with several cost pressures on employers. April 2025 saw an increase in National Insurance Contributions paid by businesses, alongside a mandatory rise in the National Minimum Wage. While these changes aim to improve financial security for workers, they also appear to have intensified the financial strain on employers, particularly in sectors where profit margins are already narrow.

Economic analysts suggest that many companies are now adopting a more conservative approach to UK workforce planning, focusing on core operations while pausing expansion or recruitment. This hesitancy may, in part, be driven by broader uncertainties surrounding inflation, consumer spending patterns, and fluctuating interest rates.

The impact is being felt across several key industries, with hospitality, retail, and administrative services among the most affected. In these sectors, where workforce fluidity is typically high, the decision not to replace outgoing staff represents a significant deviation from normal employment patterns.

Despite these indicators, the overall picture remains complex. Some regions and specialist sectors continue to report skill shortages and recruitment challenges, particularly in technology, logistics, and healthcare. However, the broader national narrative now points to a labour market gradually cooling after a prolonged period of heightened demand.

From a worker’s perspective, the slowdown in hiring could lead to increased competition for fewer available positions. At the same time, those in work may experience reduced upward mobility or delays in career progression due to limited internal vacancies. For those recently made redundant or entering the job market, the path to re-employment may be lengthier and more challenging than in recent years.

The Workers Union continues to monitor these changes closely. While policy decisions such as wage increases are fundamentally aimed at supporting working people, their interaction with business realities often creates complex outcomes. It is vital that workers stay informed, seek guidance where necessary, and remain prepared for a more competitive employment environment.

The Workers UNION Says…

”This shift in the labour market landscape calls for proactive thinking from both workers and employers alike. In a time of economic flux, clarity, communication, and support systems are more essential than ever.”